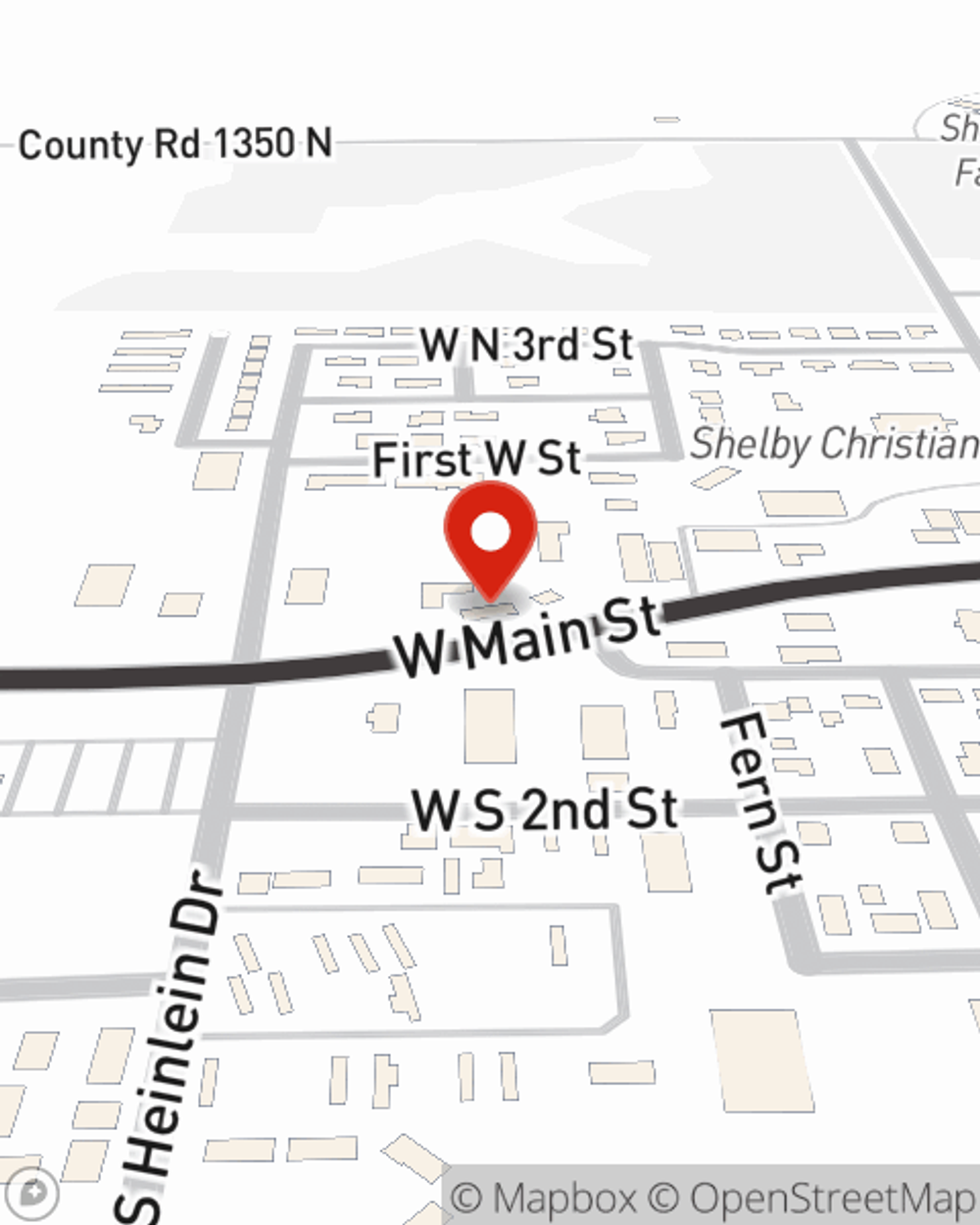

Condo Insurance in and around Shelbyville

Unlock great condo insurance in Shelbyville

Quality coverage for your condo and belongings inside

Would you like to create a personalized condo quote?

There’s No Place Like Home

Looking for a policy that can help insure both your unit and the clothing, mementos, books? State Farm offers incredible coverage options you don't want to miss.

Unlock great condo insurance in Shelbyville

Quality coverage for your condo and belongings inside

Protect Your Home Sweet Home

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your condo from fire, a hailstorm or an ice storm.

That’s why your friends and neighbors in Shelbyville turn to State Farm Agent Jeremy Jokisch. Jeremy Jokisch can outline your liabilities and help you make sure your bases are covered.

Have More Questions About Condo Unitowners Insurance?

Call Jeremy at (217) 774-2116 or visit our FAQ page.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Jeremy Jokisch

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.